VAT Invoice Format

UAE

VAT invoice

format UAE is an extremely important task for all the businesses registered

under VAT. A tax Invoice is an important document to be issued by a registrant

when a taxable supply of goods or services is made.

All the

businesses must follow the VAT invoice format issued by the FTA to avoid VAT

fines and penalties in UAE. How to prepare a tax invoice in UAE is a very

critical question and task for all businesses.

VAT-registered

business making a taxable supply shall issue an original tax invoice and

deliver it to the recipient of the supply. This requirement applies without

exception for any supplies subject to VAT at 5%, therefore in the event a

taxable supply is made it is a requirement that a tax invoice is both issued

and delivered to the recipient.

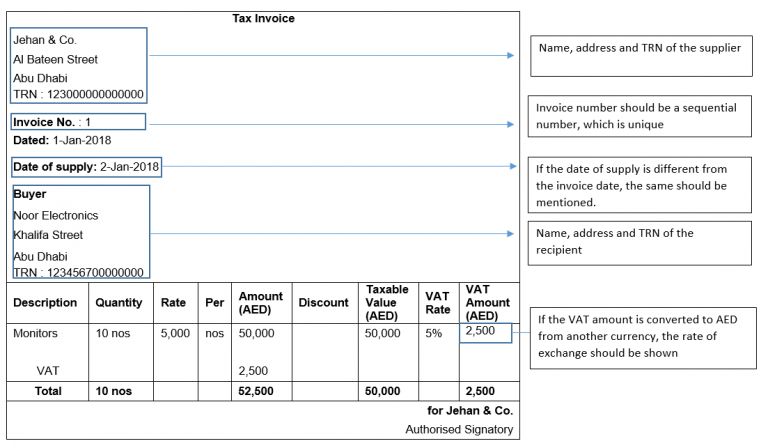

FTA Tax Invoice

Format UAE

Businesses

must follow the FTA Tax Invoice Format UAE. A VAT invoice must have a Tax

Registration Number (TRN). There are two types of tax invoices:

Simplified tax

invoice

Full tax

invoice

Simplified

Tax Invoice

In a

simplified tax invoice, line items will be shown at the gross value.

The required

contents of a simplified tax invoice will be as follows:

·

The words “Tax Invoice” are clearly displayed on the

invoice.

·

The name, address, and Tax Registration Number (TRN) of

the supplier.

·

The date of issuing the tax invoice.

·

A description of the goods or services supplied.

·

The total consideration and the tax amount charged.

At the bottom

of the simplified tax invoice, the total consideration is shown (i.e. the total

gross value), with a separate line showing the tax included within that value.

For

example:

Apples 10.00

Bananas 15.00

Milk 10.50

Total 35.50

VAT 1.69

Full Tax Invoice

In full tax

invoice, line items will be shown at the net value.

The required

contents of a full tax invoice will be as follows:

·

Name, address, and TRN of the recipient.

·

A unique invoice number must be sequential

·

Date of Supply, if it is different from the date of

issue.

·

Price per unit, the supplied quantity/volume, rate of

tax, and the payable amount in AED.

·

Discount, if applicable.

·

The payable Net value of the Invoice in AED.

·

Payable Tax Amount in AED.

A further

requirement of a full tax invoice is to show the total gross amount payable

expressed in AED. As a full tax invoice includes several line items, each shall

have the net amount payable (excluding the tax) as well as the tax due. The FTA

accepts that a full tax invoice does not need to include gross amounts (i.e.

inclusive of tax) for each line item, as the total gross amount payable for the

invoice shall be stated.

Tax Invoices Issued

in Foreign Currencies

The required

contents of a tax invoice issued in foreign currencies will be as follows:

·

the tax amount payable expressed in AED.

·

the exchange rate applied (as per the exchange rates

published by the UAE Central Bank on the date of supply).

Rounding on Tax

Invoices

Where a tax

invoice is required to be issued and the tax chargeable on the supply is

calculated as a fraction of a Fils, the value may be rounded to the nearest

Fils on a mathematical basis.

Given that

the tax amount should be calculated on a line by line basis on a full tax

invoice as mentioned above, in practice this means that such rounding, if

performed, should also be undertaken on a line by line basis.

By rounding

the value on a mathematical basis, it is meant that the tax value stated on the

tax invoice should be rounded to the nearest whole Fils (i.e. to 2 decimal

places) by applying mathematical logic.

For

example:

2.357 AED

would become 2.36

9.862 AED

would become 9.86

VAT on Discounted

Invoices

VAT will be

charged on the value which is arrived after considering the discount. VAT will

be charged on the prices after giving the discount.

The discount

will be allowed to be reduced from the value of supply only if the following

conditions which are prescribed in UAE VAT Executive regulations are met:

·

The customer has benefited from the reduction in price.

·

The supplier funded the discount.

For example,

the value of supply is AED 10,000 and discount is AED 500. In this case, the

value of supply will be AED 9,500 which is arrived after considering the

discount value. VAT will be charged on AED 9,500.

GoTrack will

take care of all the concerns related to VAT and provide you advises in light

of latest changes in VAT rules and regulation. Let GoTrack help you while

dealing with your tax matters, Contact us.