What is VAT

Deregistration?

VAT

deregistration in UAE allows a taxable person or a business to cancel their VAT

registration and suspend their Tax Registration Number (TRN). FTA VAT

Deregistration is an online process.

Only the

businesses and individuals who are registered under Federal Tax Authority (FTA)

can de-register from VAT. Late VAT Deregistration penalty will be AED

10,000.

Who must /can de-register

for UAE VAT

A business or

a person registered under VAT can only apply for VAT Deregistration in

the following circumstances:

·

If the business or a person stops making taxable supplies

and does not expect to make any taxable supplies over the next 12-month period

then they must apply for VAT Deregistration.

·

If the business or a person is still making taxable

supplies but the value in the preceding 12 calendar months is less than the

Voluntary Registration Threshold (AED 187,500) then they must apply for VAT

Deregistration.

·

If the business or a person is still making taxable

supplies but the value in the previous 12 months was less than the Mandatory

Registration Threshold (AED 375,000) and 12 months have passed since the date

of registration if you were registered voluntarily then you may apply for VAT

Deregistration.

“Note

that a person who has voluntarily registered under VAT cannot apply for

de-registration in the 12 months following the date of registration. Late VAT

Deregistration fine will be AED 10,000.”

Time Frame for VAT

De-registration

A registrant

must apply for VAT deregistration within 20 business days from the occurrence

of the above-mentioned events. Registrants can easily apply for VAT

deregistration by accessing their FTA portals.

“IMPORTANT: Please note, if the date

of submission of this de-registration form is more than 20 business days from

the date the Taxable Person is required to de-register then you will be subject

to a late de-registration penalty of AED 10,000.”

Companies

that are getting closed must have a company liquidation letter from the

government authorities to apply for VAT Deregistration.

How to apply for FTA

VAT De-registration UAE?

Businesses

can complete their VAT Deregistration by log in to their VAT portals:

·

Step 1 – Sign in to your FTA VAT portal.

·

Step 2 – On the dashboard, against the VAT registration,

click on the ‘De-Register’ button.

·

Step 3 – Taxable Person Details are pre-populated in the

de-registration application.

·

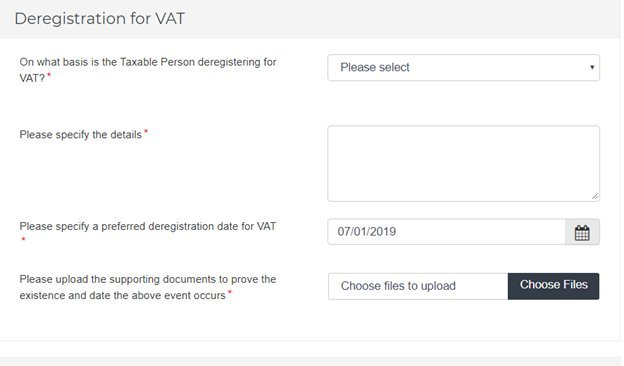

Step 4 – Reasons for VAT de-registration. Select from the

drop-down list that on what basis you are de-registering for VAT.

1.

Business no longer making taxable supplies.

2.

Business making taxable supplies, but below the Voluntary

Threshold

3.

Business making taxable supplies, above the Voluntary

Threshold, but below the Mandatory Threshold

4.

Other – please specify the reason.

·

Step 5 – Effective date from which the Taxable Person is

required or eligible to de-register depends based on the de-registration

·

Step 6 – Upload all the relevant supporting documents by

clicking on ‘Choose Files’.

·

Step 7 – Review and confirm the authorized signatory and

declaration section of the application form before submission.

“After

applying for the VAT Deregistration in UAE, FTA will review the application and

if they confirm the VAT De-registration the status of VAT De-Registration will

be changed to ‘Pre-Approved’. After that the businesses have to submit final

VAT Return Filing, after the last VAT Return filing the businesses must clear

all the outstanding liabilities in order to complete the VAT Deregistration

process.”

GoTrack Tax Consultancy will assist you in de-registering your company from FTA. GoTrack will ensure that the process of VAT deregistration will be completed without getting any VAT fines from FTA. For all kinds of VAT services in UAE, Feel free to contact us!